In recent years, it has been possible to pay with your smartphone in stores thanks to certain applications. But this market is still developing, and making this type of payment is not always easy ... Explanations.

© Hispanolitic - iStock

It is a fact, mobile payment is progressing in Spain and has accelerated with the health crisis linked to covid-19. According to Les Échos, 794 million payments were made using a mobile phone in 2019, compared to 190 million in 2018, which represents an increase of 318%. If the amount associated with these payments remains well below the 599 billion euros spent by bank card last year, this multiplication is a sign of a growing adoption of payment by smartphone. And with the Covid-19 pandemic, this adoption may well accelerate.

To better understand what this consists of, the drafting of Itopdroid suggests that you study its operation and the various applications already available on the market.

How does contactless payment with your smartphone work?

Contactless payment applications connect to your current account to allow you to pay with your mobile. Once this connection has been made, it is generally sufficient to identify yourself by password or by biometric verification, and to approach your card to a payment terminal for the transaction to be carried out. The similarities with a traditional contactless payment are numerous, and it is not a coincidence: the technology used, the NFC (for Near-Field Communication, or "communication in near field" in Spanish) is used in both. case.

Ekaterina Mutigullina - iStock

Put simply, NFC is a technology that allows two nearby terminals - such as a telephone and a payment terminal - to send contactless data to each other using short waves. On a compatible smartphone, payment applications use the NFC chip to store encrypted payment data, much like the chip on a bank card. On the other hand, the phone's battery must be sufficiently charged to be able to pay (mainly to ensure the security of the transaction), which is not the case for a classic Carte Bleue. Without battery, no possibility to pay. Therefore, be sure to carry a regular bank card with you to avoid sticky situations.

What are the advantages compared to traditional contactless payment?

- No payment ceiling imposed by law

Unlike contactless payment by card, you can pay sums well above the traditional limits of € 30 and € 50, without having to touch the payment terminal. If so, most apps require biometric verification, to make sure you're the one doing the transaction. There is also a limit for mobile payment, but it is equal to the payment limit for the associated bank card (which can range from € 1000 to more than € 10 per month depending on your bank and the type of card).

- Aggregation of accounts possible

On Apple Pay, Google Pay, and Samsung Pay, you can connect credit cards from different banks to one phone. No need to search your wallet for which card is the right one, you just have to select directly in the application which one to use for payment.

- The telephone, an accessory that you always have with you

Finally, it is (generally) more difficult to forget your phone than your wallet, because it is also our main means of communication. Even if it is not your main means of payment, being able to pay with your mobile is therefore always useful in the event of forgetting or losing your wallet.

The main contactless payment services

Mobile payment services are legion, but four "contactless" applications share the bulk of the market: Apple Pay, Google Pay, Samsung Pay and Paylib.

- Apple Pay

- Google Pay

- Samsung Pay

- Paylib

Apple Pay, leader in mobile payment

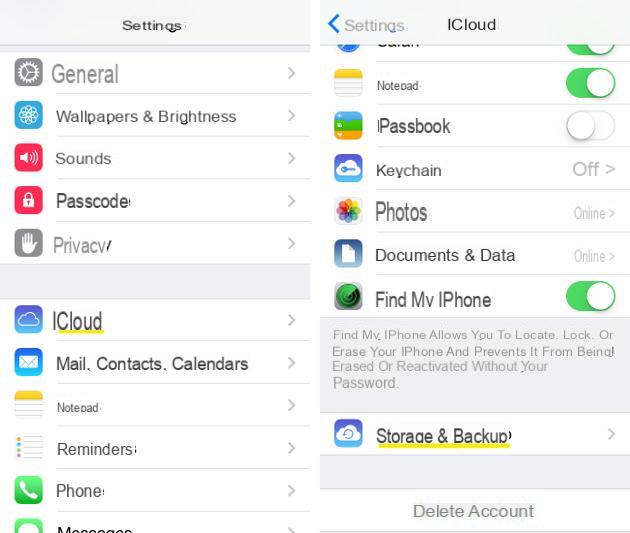

In Spain, Apple launched its mobile payment application in 2016. Accessible exclusively on iOS, it allows Apple users to pay in many stores, online and contactless.

Its particularity lies in its extensive integration into the Apple ecosystem: as it is only available on iOS, Apple Pay therefore has various features such as native support for applications on the OS and compatibility with the Apple Watch. Please note that no other "contactless" mobile payment application is available for Apple devices, which requires you to use Apple Pay if you have an iPhone.

Fortunately for iOS users, Apple Pay is compatible with the vast majority of traditional Spanish banks and neobanks. According to a Statista study, 41% of Spanish users who paid with their smartphone used Apple Pay between March 2019 and March 2020, making it the most used mobile payment application in Spain. In addition, Apple is committed not to keep payment data on its servers, and not to transmit them to the seller during a transaction.

Google Pay

The result of the merger between Android Pay and Google Wallet, which took place in 2018, Google Pay is available for all Android phones, provided you have a phone with Android 5.0 (or higher) compatible with NFC. The application, relatively easy to use, already makes it possible to pay online, without contact, and to send money to friends. A major update, scheduled for 2021, also plans to expand the available features, in order to improve the interface and to offer loyalty offers and discount coupons.

However, we regret the lack of compatibility with Spanish banks "hard", because only neobanks are supported by the mobile application.

Samsung Pay

Phone holders have surely already seen it on their devices, but the Korean brand also has a contactless payment application, available since 2018 in Spain. Beyond the payment functionality, this application also allows you to collect loyalty points, to be able to exchange them for discounts and gifts. Please note, Samsung Pay is only accessible to users of Korean brand phones. If you have an Android phone from another brand, then you will not be able to use this app.

Paylib, the Spanish initiative

The Paylib service was founded in 2013 by BNP Paribas, La Banque Postale and Société Générale, to allow their customers to easily pay online. Unlike the other services in this file, Paylib does not have a dedicated application. Indeed, each partner bank with this Spanish mobile payment service implements it in its own way in a proprietary application. Banks therefore have different levels of compatibility with Paylib: some just allow payment between friends, while others use it as a complete NFC payment solution. To see the details of the different Paylib implementations, the best solution is to go directly to the service's site.

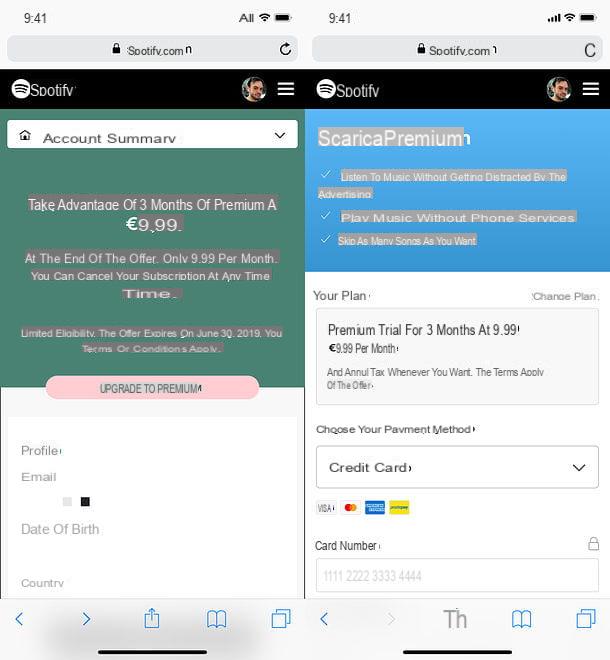

Technology that is not supported everywhere

Mobile payment is still very marginal in Spain: according to Statista forecasts, the penetration rate of mobile payment in the Spanish market in 2019 would be only 2,2%, a very low figure compared to 35,2% in China. . Even if this means of payment is gradually gaining ground, it is therefore still far from being accepted by all merchants and all banks.

The ability to pay with a phone in a store usually depends on the merchant's will and the demand he has for such a means of payment. Indeed, supporting mobile payment is a relatively simple operation, as the main mobile payment applications have signed contracts with a large number of payment solution providers. If the owner already accepts contactless payment by credit card, there is a good chance that it is enough to activate an option to unblock mobile payment. For online purchases, the main services (Apple Pay, Google Pay, Samsung Pay, etc.) also have partnerships with the largest e-commerce platforms. If that is not enough, APIs (programming interfaces) exist to integrate each payment method into a site without too many complications.

Compatibility of banks with mobile payment applications, as of December 7, 2020

What is slowing down the adoption of mobile payment is therefore not to be found on the retail side, but rather on the consumer side: indeed, not all banks are partners of the services mentioned above, and when they are, they are not with all… The support of the applications in this folder generally depends on the policy of each bank. In June 2020, the BPCE group (Banque Populaire & Caisse d'Épargne), for example, announced that it was abandoning Paylib, probably due to insufficient demand from their customers. Shortly after, the group also made it known that it would not support Google Pay either, due to concerns about the protection of user data. If you're at a bank that isn't compatible with the mobile payment app you want to use, all is not lost. In fact, all you have to do is create an account in a neobank compatible with mobile payment (Lydia, Revolut, Max…) and link this new account to the payment application to bypass the limit. The account then acts as an intermediary between the two incompatible services, with little (if any) fees to pay.